An Unbiased View of Bank Certificate

Wiki Article

Rumored Buzz on Bank Account

Table of ContentsThings about BankExamine This Report on Bank AccountBank Account Number for DummiesBank Fundamentals ExplainedThe 6-Second Trick For Bank Reconciliation

When a bank is perceivedrightly or wronglyto have issues, clients, fearing that they might shed their deposits, might withdraw their funds so fast that the tiny section of fluid assets a bank holds ends up being swiftly exhausted. Throughout such a "operate on deposits" a financial institution may have to sell various other longer-term and less liquid properties, usually at a loss, to fulfill the withdrawal needs.

Regulatory authorities have wide powers to intervene in struggling banks to decrease interruptions. Financial institutions are currently required to hold more and higher-quality equityfor example, in the kind of retained earnings and also paid-in capitalto buffer losses than they were before the financial situation.

Bank Reconciliation Can Be Fun For Everyone

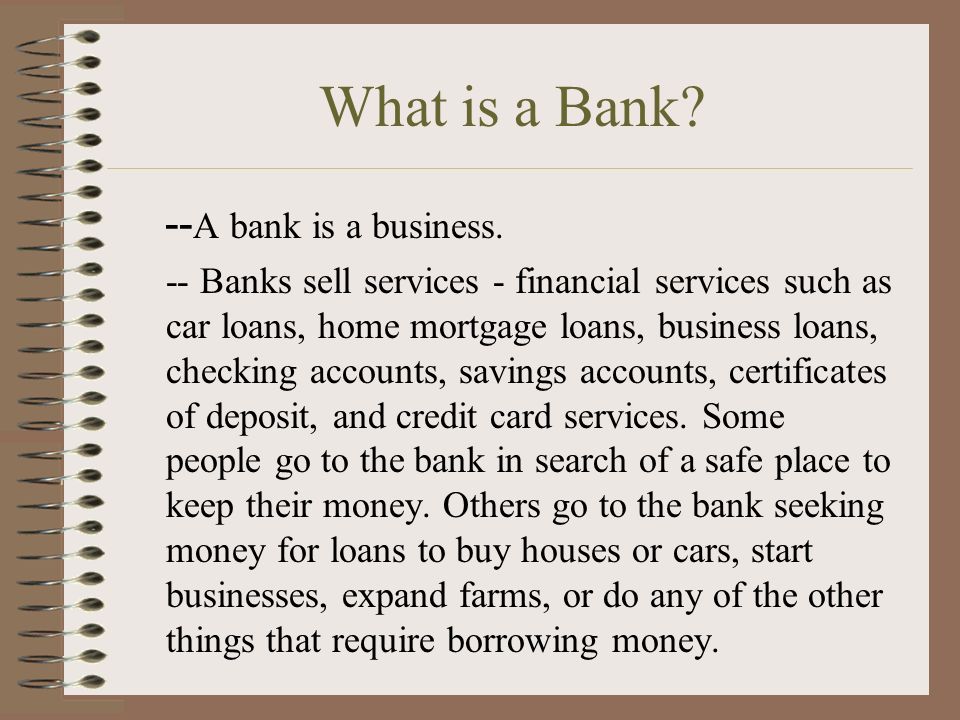

A financial institution is a monetary institution accredited to give service options for consumers who want to conserve, borrow or accrue more cash. Financial institutions commonly accept deposits from, and also deal finances to, their customers. Can help you obtain funds without a financial institution checking account.While banks might offer comparable monetary services as credit scores unions, banks are for-profit businesses that direct most of their monetary returns to their investors. That indicates that they are less most likely to use you the finest feasible terms on a funding or a financial savings account.

Those borrowers then pay the funding back to the financial institution, with rate of interest, over a fixed time (bank certificate). As the debtors settle their financings, the bank pays a portion of the paid passion to its account holders for permitting it to utilize the transferred cash for released fundings. To even more your personal and business interests, banks offer a big selection of financial solutions, each with its own positives as well as negatives relying on what your cash inspirations are as well as exactly how they may develop.

How Bank Reconciliation can Save You Time, Stress, and Money.

are financial savings products that additionally include checking account features, like debit card transactions. are containers kept in a protected facility, like a safe-deposit box, where a vital owner can position and eliminate beneficial things like precious jewelry or crucial records. Banks are not one-size-fits-all procedures. Various kinds of clients bank branch will discover that some banks are better financial partners for their goals and also requirements than others.The Federal Get controls other financial institutions based in the U.S., although it is not the only government firm that does so. Neighborhood banks have fewer possessions since they are inapplicable to a significant copyright, but they supply monetary services throughout a smaller geographic footprint, like a region or area.

Online financial institutions do not have physical areas but tend to provide far better interest prices on loans or accounts than financial institutions with physical locations. Purchases with these online-only organizations typically occur over a web site or mobile application and also therefore are best for a person who does not call for in-person support and fits with doing many of their financial digitally.

How Bank Reconciliation can Save You Time, Stress, and Money.

(C) United State Bancorp (USB) Unless you prepare to stash your cash under your bed mattress, you will ultimately need to interact with a monetary institution that can safeguard your cash or concern you a financing. While a financial institution might not be the institution you at some point pick for your economic needs, understanding just how they operate as well as the solutions they can provide can help you choose what to have a peek here search for when making your choice.Larger financial institutions will likely have a bevy of brick-and-mortar branches as well as ATMs in hassle-free areas, along with many electronic financial offerings. What's the difference between a financial institution and a lending institution? Due to the fact that financial institutions are for-profit organizations, they tend to provide less attractive terms for their customers than a cooperative credit union could offer to take full advantage of returns for their investors.

a lengthy raised mass, esp of planet; pile; ridgea slope, since a hillthe sloping side of any type of hollow in the ground, esp when surrounding a riverthe left bank of a river gets on a spectator's left looking downstream an elevated area, increasing to near the surface area, of the bed of a sea, lake, or river (in mix) sandbank; mudbank the area around the mouth of the shaft of a mine the face of a body of orethe lateral inclination of an aircraft regarding its longitudinal axis throughout a turn, Likewise called: banking, camber, cant, superelevation a bend on a road or on a train, athletics, cycling, or other track having actually the outdoors constructed more than the within in order to decrease the results of centrifugal pressure on cars, runners, and so on, rounding it at rate and also in many cases to assist in drainagethe cushion of a billiard table. bank code.

The Only Guide to Bank Statement

You'll require to supply a bank statement when you request a funding, data taxes, or declare separation. Packing Something is loading. A financial institution statement check my source is a file that summarizes your account activity over a particular amount of time. A "declaration period" is usually one month, yet maybe one quarter in many cases.

Report this wiki page